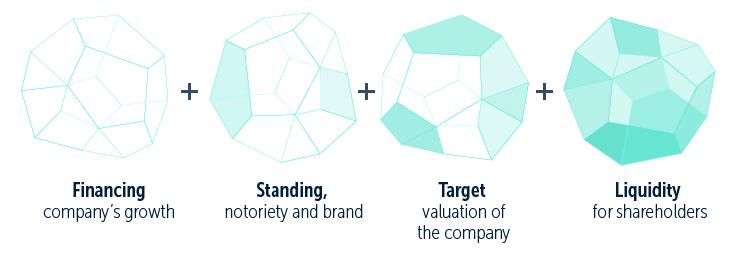

The securities market can be the ideal platform for companies to grow. BME Growth offers growth companies many advantages including access to financing, increased visibility, a constant valuation based on supply and demand and liquidity for their shares. This in turn means companies can manage their projects more efficiently and hasten the processes needed to do so. In fact, all these opportunities offered by the market can form a virtuous cycle for a company to expand. Increased visibility attracts more investors and therefore a more efficient way of raising finance; at the same time, more investors helps boost the shares' liquidity which in turn helps the company obtain its target valuation on the market.

Let's look in more detail at the main advantages of the securities market.

On BME Growth, companies are able to generate finance through equity and obtain capital with which to grow

In an ever more competitive business climate, continuous growth has become one of the basic objectives for companies. An effective management team should aim not only to obtain the resources required, but also to maintain a balance between equity and borrowing.

A capital increase which coincides with a market flotation, or a subsequent issue, is the perfect way to obtain funds to sustain a company's expansion. BME Growth is the most appropriate way for growth companies to generate finance through equity.

Listed companies often use their own shares as payment in mergers and takeovers. As there is a market for the shares, when a company is absorbed, its shareholders can choose whether to remain part of the new company or whether to sell their shares on the market at a time of their choosing.

They can also use their shares for a share exchange with shareholders of other companies in order to take a substantial reciprocal shareholding in each other’s companies.

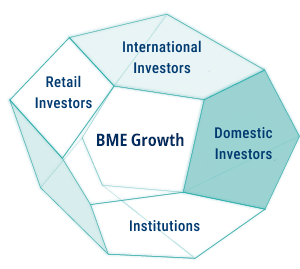

BME Growth raises the visibility of listed companies

Listing on BME Growth brings a company liquidity, transparency and prestige. A company which is ready to list on BME Growth has attained a high level of organisation and control. And above all, it has secured investors' confidence in its project.

This prestige is recognised by clients, suppliers and financial institutions which helps relations.

BME Growth is in the news every day. Listed companies enjoy wide media coverage as investors and analysts are eager for information. This media interest boosts the company's prestige and brand and complements its other marketing and advertising efforts.

Market valuation is a valuable benchmark for management to take decisions.

The shares of companies listed on BME Growth have a target value. In fact, share prices are shaped by supply and demand. BME Growth, and all markets in general, incorporates growth and profit forecasts, together with other external variables, into its valuations of listed companies. This feature distinguishes the prices set by the markets from those established by other means.

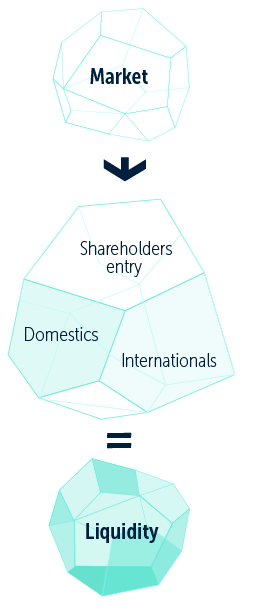

Share liquidity increases the appeal and value of listed companies

The ease with which shares can be converted into cash is one of the main appeals of this market for shareholders and potential investors.

The ease with which shares can be converted into cash is one of the main appeals of this market for shareholders and potential investors.

Shares of listed companies are a highly liquid payment instrument which can be used in financial transactions. In fact, many capital increases involving companies listed on BME Growth have not been in cash, i.e. the company's shares have been used as consideration in the acquisition of another company.

Also, companies listed on BME Growth have “liquidity providers”. This is an intermediary with whom the company or some of its core shareholders sign a liquidity contract. The liquidity provider offers sales and purchase positions during the market session to ensure constant liquidity for the stock. The objective of liquidity contracts is to guarantee transactions are liquid, ensure sufficient trading frequency and reduce fluctuations in price which are not caused by market trends.

What is BME Growth

Companies

Indices

News and Publications

Copyright © BME 2026. All rights reserved.

BME Growth

BME Growth